Unemployment is 8% nationally on first $ 9600

Wal-Mart Fights Bill Listing Workers on Public Health Care

Unemployment rate

il unemplyement

rate employers  walmart

B

walmart

B S

S

FUTA is Federal Unemployment

Computing the tax. The FUTA tax is imposed at a single flat rate on the first $7,000 of wages that you pay each employee. Once an employee's wages for the calendar year exceed $7,000, you have no further FUTA liability for that employee for the year.

The FUTA tax rate is a flat 6.2 percent on the first $7,000.. However, you can generally claim credits against your gross FUTA tax to reflect the state unemployment taxes you pay. If you paid all your state unemployment taxes on time, and before the due date of your FUTA tax return, you'll be allowed to claim a credit equal to 5.4 percent of your federally taxable wages. This will effectively reduce the FUTA tax rate to 0.8 percent. The fact that your actual state tax rate is far below 5.4 percent doesn't matter — the federal credit is fixed at that rate.

The FUTA tax is scheduled to decrease to 6.0 percent, which means an effective rate of 0.6 percent, effective January 1, 2008. However, this decrease has been postponed in the past and may well be postponed in the futureTexas umemployment rates

Wal-Mart's average employee working in the US makes $15,000 a year, $7.22

per hour! The company brags that 70% of their employees are full time, but,

fails to disclose that they count anyone working 28 hours a week or more, as

full time. There are no health care benefits unless you have worked for the

company for two years. With a turnover rate averaging above 50% per year,

only 38% of their 1.3 million employees have health care coverage. In

California alone it's estimated that the taxpayers pay over $20 million

annually to subsidize public health care benefits for these employees who

get none from this behemoth corporation.

This company runs ads featuring the United States flag and proclaims "We Buy

American". In 2001 they moved their world-wide

purchasing

headquarters to China and are the largest importer of Chinese

goods in the US, purchasing over $10 billion of Chinese made products

annually. Products made mostly by women and children working in the labor

hell-holes, China is famous for.

Wal-Mart says 56 percent of its workers are covered through the company's health plan. Premiums start at $40 a month for single workers and $155 for families. The rest are covered by other private and public health plans.

But critics say Wal-Mart's long waiting period to qualify for health coverage (six months for full-time employees and two years for part-timers), coupled with the health program's $1,000 deductible, keeps it out of reach for most working families.

As a result, critics say, families are turning to public aid just as most states and the federal government are seeking to scale back Medicaid.

And, figures suggest that Wal-Mart will not be appearing on any "Greatest

Places to Work" lists anytime soon. According to the

Economist, Wal-Mart's turnover rate is 44 percent. At some stores,

the annual turnover is as high as 300%.

Wal-Mart has been cited

for

1,371 Child Labor Law violations. Following a 21-state sting operation,

Wal-Mart is the subject of a federal grand jury investigation

for its

use and abuse of undocumented workers with no benefits or overtime pay

protections. Its strong-arm tactics have subjected Wal-Mart to

more

than 40 National Labor Relations Board complaints for everything from

intimidating workers to unlawful dismissal of union supporters.

Profit

Sharing & 401(k). In recent years, we have contributed up to 4

percent of an associate’s eligible pay to a combined Profit Sharing/401(k) Plan.

More than 425,000 Wal-Mart employees, most of them

women, have no company-provided health coverage.

Buy own stock

Sixty percent of our associates are female at Walmart and women make up just over forty percent of our managerial population, including professionals such as opticians and pharmacists.

Health care. We insure more than 500,000 associates, including many family members, who pay as little as $17.50 for individual coverage and $70.50 for family coverage bi-weekly. Unlike many plans, after the first year, Wal-Mart’s Associates’ Medical Plan has no lifetime maximum for most expenses, protecting our associates against catastrophic loss and financial ruin. Historically, Wal-Mart has paid about two-thirds of the cost of the Associates' Medical Plan.

Wal-Mart is a leading employer of Hispanics in the U.S. with more than 775,000 females; 139,000 Hispanic associates; a leading employer of African Americans with more than 208,000 African Americans; and an employer of more than 220,000 seniors who are 55 and older.

THE ASSOCIATED PRESS

Chattanooga - A study shows that thousands of Wal-Mart employees are on TennCare, the state's expanded Medicaid program, providing fodder for critics who say the retail giant and other businesses are shifting costs for low-paid employees onto the backs of taxpayers.

Wal-Mart, with 9,617 employees listed as receiving benefits from the program, said it offers health plan available to full-time workers after six months and to part-time employees after two years. Critics said the high cost of the retailer's insurance is out of reach for low-income workers who are forced to turn to publicly financed health insurance.

The figures come from a survey conducted during the past two months of TennCare rolls and labor Department data, requested by the Chattanooga Times Free Press. It shows the number of TennCare enrollees who were employed by Tennessee companies at some point during the year. The top 20 companies on the list employed a total of 68,303 TennCare recipients roughly 6 percent of the 1.3 million people now on the state's health care plan.

State officials said they were going to keep looking at the data, as it may be somewhat imprecise because of high employee turnover rates at the private companies. “The fact of the matter is there is a trend here that large employers have a large number of TennCare enrollees on the rolls, and we have to find out what's behind that,” said TennCare spokesman Michael Drescher.

Wal-Mart, with about 25 percent of the company's 37,000 workers on TennCare, tops the list of businesses with employees on the expanded Medicaid program. Wal-Mart is the state's largest private employer.

Wal-Mart spokesman Dan Fogleman called the retailer s benefits “competitive.” “If there are some of our associates who have decided for some reason not to participate in our health plan, we don't know the reason,” he said.

Phil Mattera, a research director of Good Jobs First and a Wal-Mart critic, said the list of employers with Medicaid-dependent workers shouldn't include the largest and most profitable companies in the country. “There was a time when the biggest company in the land — Ford Motor Co. in the early 20th century and General Motors after World War II — set the pace for raising wages and benefits,” he said. “But Wal-Mart seems to be leading us downhill and, in effect, using the government to help pay for its expansion by not giving its workers a sufficient health benefit plan, in many instances.”

Last year, a study in California found that Wal-Mart workers there cost that state an estimated $32 million because of their reliance on public assistance programs. “Wal-Mart, in its effort to drive costs down, shifts part of their costs on to the public sector,” said Ken Jacobs, deputy chairman at the institute who authored the study on the “Hidden Cost of Wal-Mart jobs.”

Temporary employment agencies represented~ seven of the top 10 companies with employees on TennCare, while Chattanooga-based Krystal Co. was ninth on the list with 3,183 employees. Goodlettsville-based discount retailer Dollar General was 10th with 3,002 employees on TennCare. “It's egregious,” said Jerry Lee, president of the Tennessee AFL-CIO. “The AFL has long been aware that these kinds of companies are putting their employees on the public dole.”

Legislation in the works this year would require the state to track all companies that have at least 25 employees or their family members enrolled in TennCare.

Gordon Bonnyman, executive director of the Tennessee Justice Center, suggested that the state should offer reforms that allow large companies such as Wal-Mart with low-wage earners to buy into TennCare or other insurance health insurance. “It would be good if we could get private employers to pitch in and do their fair share, and take advantage of the economy of scale and volume that TennCare provides,” Bonnyman said, “Nobody understands volume discounts like Wal-Mart.”

EDITOR'S NOTE: If you are a TennCare patient who has received a letter stating that you have been dropped from the program, we'd like to talk to you. Please e-mail Staff Writer David McGee at dmcgee@bristolnews.com or call (276) 646-2532.

Copyright January 21, 2005 Bristol Herald Courier

A study of Tennessee businesses shows thousands of Wal-Mart employees are on TennCare, the state's expanded Medicaid program, providing fodder for critics who say some businesses are shifting costs for low-paid employees onto the backs of taxpayers.

Wal-Mart, with 9,617 employees listed as receiving benefits from the program, said

ALABAMA: The Montgomery Advertiser found in February 2005 that families of Wal-Mart workers are the top dependents on Medicaid. 3,864 children of Wal-Mart employees depend on Medicaid for health insurance. The next highest company, McDonald's, has 1,615 employee's children on the program.

FLORIDA: In December 2004, the Tallahassee Democrat revealed that 50,000 workers and their dependents rely on Medicaid for health insurance. McDonald's was the worst culprit in the Sunshine State, with 1,792 claims filed. Wal-Mart had 756.

GEORGIA: 10,261 children of Wal-Mart workers rely on PeachCare for Kids, the state's program for low-income families, according to a February 2004 report in the Atlanta Journal-Constitution.

TENNESSEE: 25% of Wal-Mart workers in Tennesse are enrolled in TennCare, the state's health plan for the poor and uninsured, according to a January 2005 investigation by the Memphis Commercial Appeal. That's 9,617 employees.

WEST VIRGINIA: The Charleston Sunday Gazette-Mail revealed last December that 452 Wal-Mart workers in the state have children dependent on the State Children's Health Insurance Program, the most of any company.

(Note: this isn't just a Southern thing, of course. The survey also looks

at reports out of Connecticut, Massachusetts, Washington, and Wisconsin. And I

notice a story out today showing that

845 Wal-Mart

employees in Iowa rely on Medicaid for health insurance.)

Most disturbing of all is that Wal-Mart is driving up public assistance

caseloads at the very time state lawmakers

are demanding sharp cuts in these programs. For example, Tennessee's

excellent TennCare program is under assault due to rising costs (in part

caused by Wal-Mart and kindred companies), with

proposed cuts that could strip thousands of health coverage.

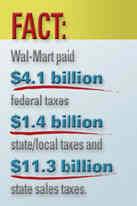

And as if that isn't bad enough, an earlier report by GJF shows that

state and local

governments have given Wal-Mart subsidiaries over $1 billion in tax breaks and

other "incentives" to set up their stores -- money the company clearly

doesn't need.

So the public is paying twice -- in direct corporate welfare, and indirect

costs from workers driven into poverty -- to subsidize a giant company that's

swimming in profits,

exploits workers,

busts unions,

drains community resources,

exacerbates urban

sprawl, violates

human rights abroad, and otherwise violates the public trust.

Where's the "moral values" crowd when you need them?

PEACHCARE FOR KIDS

• What it is: A health care program for uninsured children in Georgia,

part of a national initiative begun in the Clinton administration.

• Eligibility: Available to children up to age 18 whose families meet

income criteria based on federal poverty guidelines. For a family of four,

$43,260 a year is the family income limit. State employees' children aren't

eligible.

• Member costs: Premiums are required for children ages 6 and older. The

cost per child per month is $10. Families with two or more children pay $20 for

all children. Georgia is considering raising those premiums.

Source: Georgia Department of Community Health

WHO USES PEACHCARE

Employers with 300 or more children in PeachCare in September 2002:

Self-employed 12,789

Wal-Mart 10,261

Publix 734

Shaw Industries 669

Mohawk Industries 657

Cagle's Keystone Foods 463

McDonald's 454

Home Depot 421

Kroger 377

U.S. post office 354

Construction 328

Sears 325

Randstad Staffing 305

Grady Healthcare 300

Source: Department of Community Health. The figures are self-reported

information from PeachCare applications.

One recent study, conducted by a pro-labor group called Good Jobs First,

estimated that Wal-Mart has benefited from at least $1 billion in assorted

subsidies for its stores and distribution centers.

In many cases, it appears local and state politicians are eager to offer special

favors to Wal-Mart, which in turn promises tax revenue, jobs and possibly a

ripple effect of redevelopment. With so many communities willing to waive

Wal-Mart's property taxes, discount its land and build its parking lots, the

company is in position to demand such special favors from any town or county

where it is considering locating.

The Commonwealth of Virginia, for example, has helped Wal-Mart set up four

distribution centers. In James City, the county and state handed over a combined

$578,000 in grants. The Governor's Opportunity Fund issued a $500,000 grant to

Wal-Mart in Louisa Co. and a $1.5 million grant for the distribution center in

Mount Crawford. In Sutherland, the state government used a $700,000 Community

Development Block Grant (federal money) to help build infrastructure for the

distribution center site in 1991.

|

|

|

Social Security

is the federal retirement and security

income

program run by the U.S. Social Security Administration (SSA). Social

Security has existed since the Great Depression of the 1930s.

|

Nike factory

|

||||