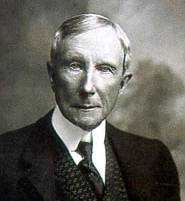

Rockefeller and Rothschild Dynasties Join Forces

By MARK SCOTT

LONDON — Two of the world’s best-known banking families are

combining forces after RIT Capital Partners, the investment trust

led by Jacob Rothschild, said on Wednesday that it was buying a

minority stake in the investment and wealth management firm

Rockefeller Financial Services.

Under the terms of the deal, RIT Capital will buy a 37 percent stake

in Rockefeller Financial Services, a firm founded in 1882 that now

handles about $34 billion in client assets.

The price was not disclosed. RIT Capital said it would acquire the

stake in the firm from Société Générale Private Banking of France.

Article Tools

RIT Capital and Rockefeller Financial Services said that they would

collaborate on investment opportunities and other areas of shared

expertise. The transaction will also give RIT Capital, which is

based in London, a presence in the United States. The deal is

expected to close by the end of September.

“We are delighted at the prospect of bringing together these two

entities in a long-term partnership,” Mr. Rothschild, chairman of

RIT Capital, said. “The creation of this partnership with the

Rockefeller family is truly historic.”

The deal between the two well-known banking families comes after RIT

Capital, whose assets total £1.9 billion, or $3 billion, announced a

partnership in March with the Edmond de Rothschild Group, an

international private banking and asset management group led

Benjamin de Rothschild.

The Rothschilds, whose banking dynasty dates to the 18th century and

operates across a number of European countries, are also

consolidating their French and British operations.

In a deal announced on April 5, Paris Orléans, the Rothschild

Group’s holding company, said it was buying minority stakes in its

subsidiaries, including N. M. Rothschild & Sons, the investment bank

based in London, and the group’s French asset management business.

|